New Delhi: Even if the consumer price index (CPI) for “cereals and products” increased 11.53 percent year over year in September, the stockpiles are dwindling.

In spite of the fact that the inflation rate for retail grain prices jumped to a 105-month high in September, stocks of wheat and rice held by government agencies have fallen to a five-year low.

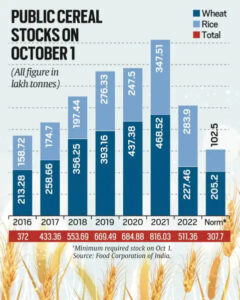

The Food Corporation of India (FCI) reported that as of October 1, there were 511.4 lakh tonnes (lt) of wheat and rice stored in public godowns. This was the lowest for the same period since 2017 and was down from 816 lt a year earlier (see table).

Wheat stocks were at a six-year low on October 1 at 227.5 lt, just over the minimum buffer of 205.2 lt (the three-month operating stock need plus the strategic reserve to cover procurement gaps) for that day. However, rice stocks were roughly 2.8 times more than they needed to be (including grain from unmilled paddy). As a result, even if FCI warehouses were carrying less grain than they were even four years prior, the position of the overall cereal supplies back then was still rather secure.

Even if the Consumer Price Index (CPI) for “cereals and products” increased 11.53 percent year over year in September, the stockpiles are dwindling. According to the current pricing index, which uses 2012 as its base year, that was the cereal category’s highest-ever yearly inflation rate. The previous greatest rate of cereal inflation, using the old CPI with 2010 as the base year, was 12.14 percent, which was noted in December 2013. Back then, there were eight years and nine months.

Further, International prices add to the uncertainty. On March 7, the benchmark wheat futures contract traded at the Chicago Board of Trade exchange reached a record price of $12.94 per bushel. By August 18, it had dropped to $7.49. But since then, there has been a new rise in demand, with prices closing at $8.82 per bushel on Wednesday due to the rising tensions in Ukraine (one bushel equals 27.216 kg).

The export price of wheat from Russia increased from $313 to $327 per tonne, free on board, during the course of the previous month, according to the most recent report on global grain trade from the US Department of Agriculture. Wheat from various origins, including the European Union ($334 to $359), Australia ($372 to $376), Canada ($369 to $402), Argentina ($400 to $420), and the US ($392 to $459), has seen even greater price hikes. Even Russian wheat would cost between $365 and $370 per tonne when it is landed in India after adding ocean freight and shipping insurance. When calculated at the port, that is Rs 30–30.5/kg, making imports unprofitable unless done on a government account with the intention of replenishing public inventories.

Comments are closed.