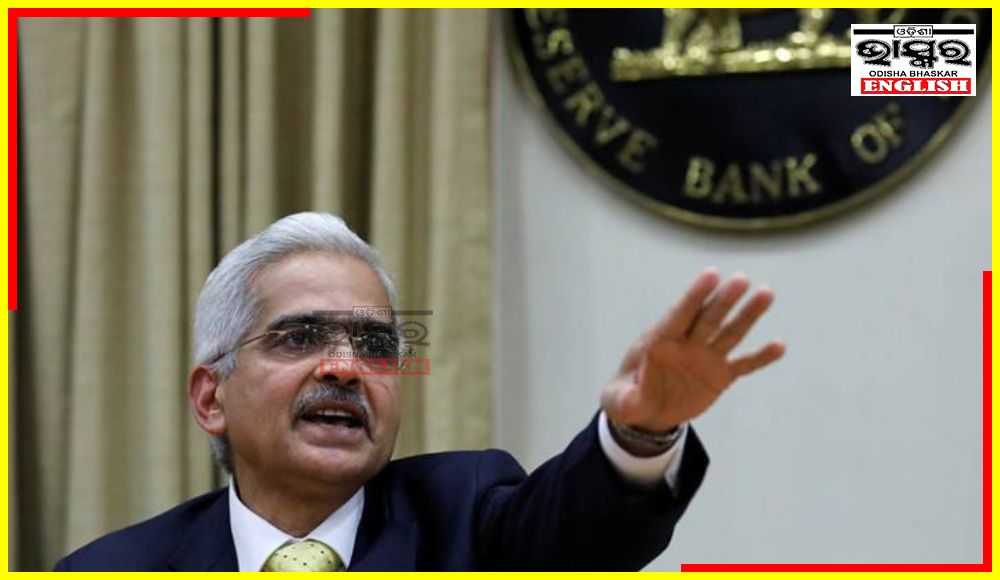

New Delhi: The Monetary Policy Committee (MPC) of the Reserve Bank of India has hiked the key interest rate by 25 bps to 6.5 per cent. The MPC is focused on ensuring that inflation remains within the central bank’s tolerance level of 2-6 per cent, said RBI Governor Shaktikanta Das.

The governor said four members of the six-member MPC voted for the increase with immediate effect. For the commoners, this means that the EMI of loans will increase.

“Based on an assessment of the macroeconomic situation and its outlook, the MPC decided to increase the policy repo rate by 25 basis points to 6.5 per cent, with immediate effect,” he said.

Governor Das added that the Standing Deposit Facility (SDF) rate will stand revised to 6.25 per cent and the Marginal Standing Facility (MSF) rate will now be 6.75 per cent.

On inflation, the governor said consumer price inflation (CPI) moved below the upper tolerance level of 6 per cent during November and December 2022, driven by a strong decline in prices of vegetables. Regarding inflation, he said, “Looking ahead, while inflation is expected to moderate in 2023-24, it is likely to remain above the 4 per cent target. The outlook is clouded by continuing uncertainties from geopolitical tensions, global financial market volatility, rising non-oil commodity prices and volatile crude oil prices.”

The central bank’s MPC hiked key interest rates for one last time in the ongoing financial year.

On growth, the central bank governor said economic activity in India remains resilient and projected the real GDP growth at 6.4 per cent for 2023-24.

Comments are closed.